6.1 Summary of results

| €M | 2020 | 2021 | 1 Excluding non-recurring expenses. |

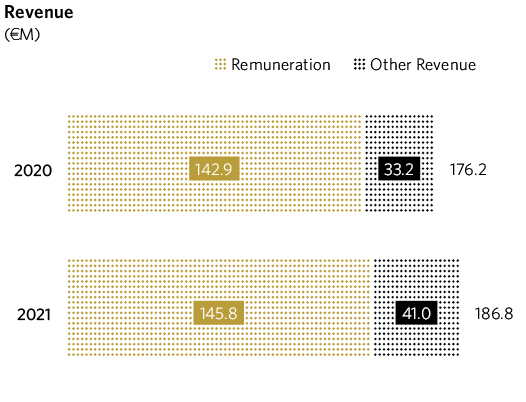

| Remuneration | 142.9 | 145.8 |

| Other revenues | 33.2 | 41.0 |

| EBITDA1 | 139.7 | 141.3 |

| EBIT | 106.8 | 106.7 |

| Net profit | 64.4 | 70.3 |

While still feeling the effects of the pandemic, 2021 began with Storm Filomena and ended with high levels of volatility and uncertainty in the markets. In this context, MRG has continued to show its capacity to maintain stability against adverse economic cycles and unexpected events, obtaining excellent results that confirm great financial resilience, with a solid position of foreseeable revenue creation.

Company revenue was €187 million, a 6% increase compared with 2020. This variation is due mainly to greater turnover, at almost €3 million, and to increased revenue of €8 million in other areas, compared with 2020.

MRG’s main source of revenue is turnover from its distribution activity. It is calculated each year using a parametric formula and varies depending on the growth in supply points and demand conveyed through the network. The demand for gas conveyed through the network increased in 2020 compared with 2020, both in terms of connection points for domestic use and among commercial and industrial clients, due to colder temperatures in winter and increased economic activity. This led to an increase in turnover, which exceeded that of 2020, easily offsetting the gradual cutback applied in this first year of the regulatory period (2021-2026).

MRG’s main business is the distribution of natural gas, which is a regulated activity. The regulatory periods for this activity are in six-year cycles, and 2021 was the first year of a new regulatory period (2021-2026), the framework for which had been defined and published in 2020. The methodology for calculating payment is along the same lines as previously, but also includes a gradual revenue adjustment over the period set. Notably, it establishes gas years that differ from the calendar year, as this first gas year, 2021, was for a period of nine months (1 January 2021 to 30 September 2021). The subsequent gas years are for 12 months, beginning on 1 October and ending on 30 September. The offset for MRG corresponding to the 2021 gas year was €2.7 million, whereas for the calendar year it was €4.7 million.

The increase in other revenue is due to the consumption of liquid petroleum gas (LPG), distributed through the network, which in 2021 rose by 4.5% with regard to 2020. This was due to the low temperatures, added to the rising price of LPG and the conducting of regular inspections, which must be carried out every five years at every supply point in the company’s network, and these inspections are not spread out evenly over the five years. More inspections were carried out in 2021 than in the previous year, which led to an increased revenue from inspections of €4.5 million compared with 2020.

In the 2021 financial year, the EBITDA amounted to €141.3 million, a 1% growth over 2020, due to the increased revenue recorded. The EBITDA figure also includes greater costs than the previous year due to differences in how gas is metered, mainly caused by the change in the gas year and by rising gas prices.

The 2021 financial year was the first time that the gas year ended on 30 September, meaning that unusually this first gas year lasted only nine months. The second gas year also began in 2021, and will end on 30 September 2022. In terms of the costs recorded for this concept throughout the current financial year, they are impacted by two gas years with two different regular gas prices. This, in conjunction with the fact that when entering the metering differences there are major seasonal fluctuations, combined with rising gas prices, has affected the one-off cost estimate by approximately €4 million, which could be offset when the price trend reverses, leading to the opposite effect.

The company’s growth strategy continues to focus on profitable and sustainable expansion both in our region and in adjacent areas. The company’s customer base continues to grow, and in 2021 the company was able to maintain the same rate of growth as in the years prior to the pandemic. As of the close of 2021, Madrileña Red de Gas distributes gas to 915,209 supply points, of which 893,311 are for natural gas and 21,898 are for LPG.

Other aspects underpinning this growth strategy are the commitment to decarbonisation and replacing more polluting and less efficient energy sources, promoting the use of NGV, robotising, digitalising and automating processes, the focus on customer satisfaction and renewable gases, which include green hydrogen.

6.2 Operational results

In 2021, our EBITDA amounted to €141.3 million, 1% more than in 2020. The higher turnover figure accounts for this increase in the operation result.

6.3 Revenue

Total revenue in 2021 was €186,8 million, a 6% drop compared with 2020, due mainly to a higher demand for gas due lower higher temperatures and a seasonal effect due to the higher number of inspections made when compared with previous years.

Total revenue in 2021 was €186,8 million, a 6% drop compared with 2020

A total of 97% of the company’s revenue stems from regulated activities. In practical terms, 80% of this is the revenue from distribution, legally recognised in the resolution of 18 December 2019 issued by the CNMC on the payment of companies conducting regulated activities relating to LNG plants, transport and distribution for the 2021 financial year, and the adjustments that have been made and estimated based on the evolving demand for gas. The remaining 20% is from other services related to natural gas distribution, such as rental of meters, regular inspections, other consumer services and the sale and distribution of LPG.

6.4 Financial position and balance sheet

Financial strength is one of the strategic mainstays of Madrileña Red de Gas. The company has strong levels of solvency and liquidity consistent with an investment grade. The financial structure is efficient and long-term. In 2021, gross debt amounted to €950 million, with an average maturity period, at the close of 2020, of six years, approximately, and an average cost of 2.7%.

MRG also has a contingent credit line of €75 million, which was renewed in February 2022, in line with the company’s real needs for the coming years. At the financial year’s close, the company’s available liquidity amounted to €108.5 million.

Flexibility in the company’s dividend policy is another feature that ensures MRG enjoys a better financial position.

The group’s debt is issued by MRG Finance, in the regulated Luxembourg market under the EMTN programme. This debt is classed as investment grade (BBB-) by S&P Global Ratings and DBRS Morningstar. During the 2021 financial year, both agencies re-confirmed their credit rating of BBB- and BBB low, respectively.

| €M | 2020 | 2021 |

| Gas distribution licences & other intangibles | 751.0 | 751.0 |

| Net tangible fixed assets | 339.2 | 318.1 |

| Total network fixed assets | 1,090.1 | 1,069.1 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax assets | 17.9 | 14.7 |

| Other non-current assets | 212.1 | 339.2 |

| Current assets | 47.7 | 34.5 |

| Cash | 46.6 | 33.5 |

| Total assets | 1,417.8 | 1,548.4 |

| Equity | 362.5 | 432.8 |

| Long term debt | 945.2 | 944.6 |

| Deferred income tax liabilities | 70.0 | 79.9 |

| Other non-current liabilities | 38.6 | 36.1 |

| Current liabilities | 55.6 | 54.9 |

| Total liabilities & shareholders equity | 1,471.8 | 1,548.4 |

6.5 Operating cash flow

Operating cash flow was €126 million, 6% lower than in 2020. This variation is mostly due to the working capital position at the close of 2021. The 2020 financial year was characterised by increased cash flow resulting from adjustments to turnover from previous positive years, whereas in 2021 the adjustments to turnover from previous years were negative. At the same time, the system’s deficit position improved in comparison with the previous year, partially offsetting the negative effect of the adjustments to the position’s negative turnover with the system.

| €M | 2020 | 2021 | 1 InaccordancewiththeInternationalFinancialReportingStandards(IFRS). 2 Excluding one-off operations (incoming payment of the Castor project in 2020). |

| EBITDA | 139.7 | 141.3 |

| Income tax paid | (7.1) | (5.6) |

| Working capital 2 | 15.5 | 3.4 |

| Capex | (14.3) | (13.1) |

| Free cash flow2 | 133.8 | 126.0 |

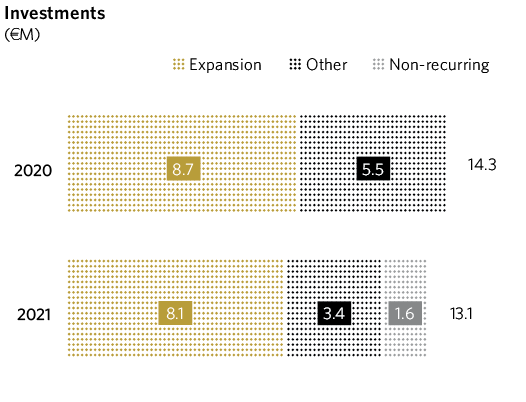

6.6 Investments

In 2021 investments were made totalling €13.1 million, a similar amount to the investments made in the previous year. These investments can be divided as follows:

Network expansion

MRG invested a total of €8.1 million in expanding its pipeline network, in alignment with its strategy of viable and sustainable expansion.

Other projects

Investments remained at a similar level to those made in previous years, and were used for network maintenance, digitalisation, automating processes and developing information systems, which are chiefly aimed at reaching our targets of cost efficiency and improvements in the quality of our customer service.

MRG invested a total of €8.1 million in expanding its pipeline network, in alignment with its strategy of viable and sustainable expansion.